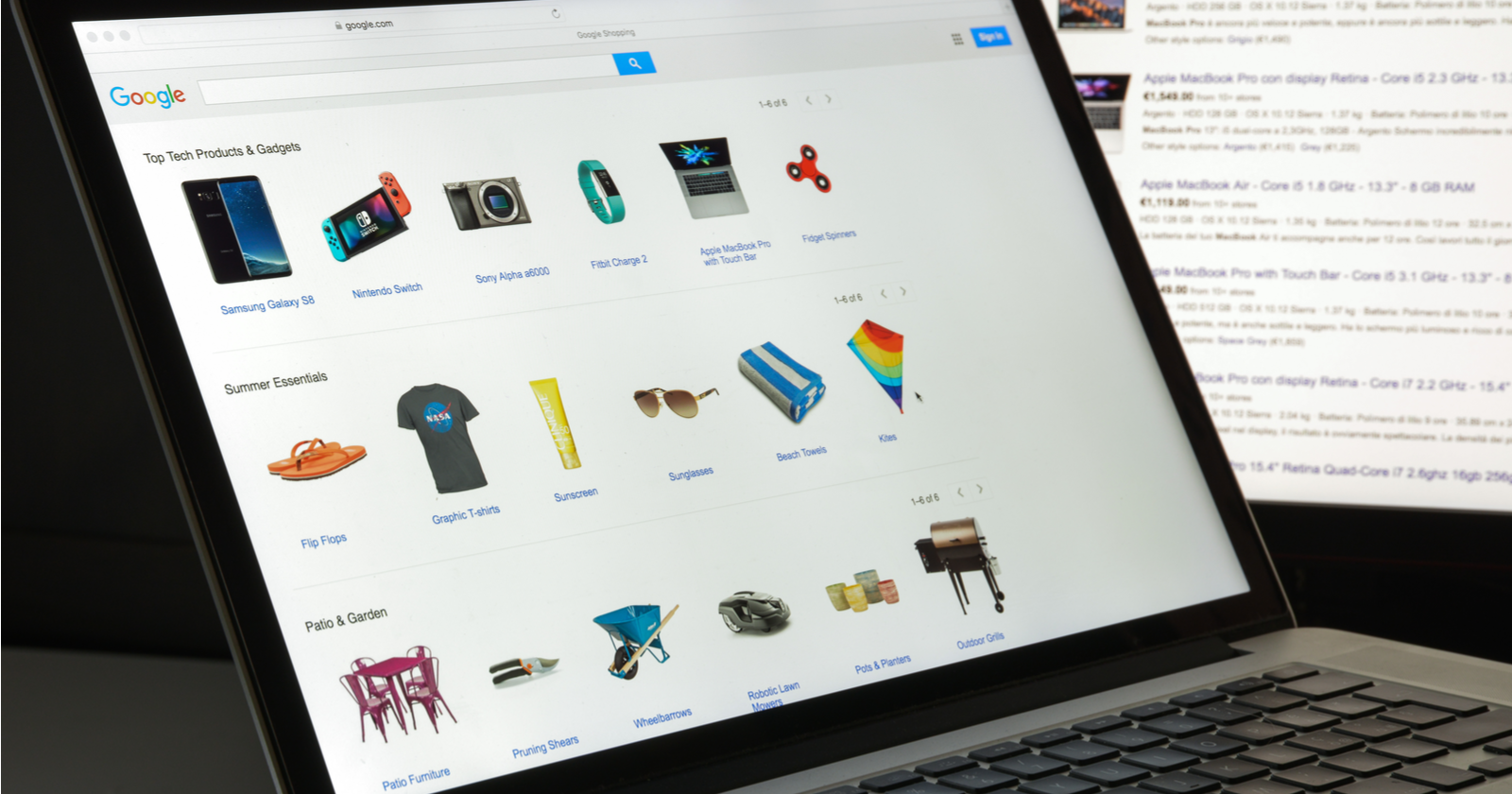

Last year, Google made a considerable push to bring volume and recognition to Shopping Actions, most visibly accessible through the Google Express web and app experience.

It became what you might also call Google’s marketplace – where some major retailers like Target, Fry’s, Overstock, and Best Buy were listing products alongside smaller retailers and brands.

Google was also experimenting with ad units called Sponsored Products on Search, where products for sale on the Express site were listed in the product listing ads carousel.

Not to be confused with Shopping Actions (which is the transactional technology where Google acts as the payment and order processor that is found on and in multiple Google products like Google Home), Google Express uses the Shopping Actions technology to power the marketplace experience to enable single cart checkout and order management.

How Shopping Actions Did in 2018

How Sellers on Shopping Actions Fared

How did Shopping Actions generally fare against other marketplaces (excluding Amazon) across our network (Disclosure: I work for CommerceHub):

Why exclude Amazon?

Because Amazon by comparison in volume (number of orders and amount of revenue) is so much larger than any other marketplace, it skews the comparison into ridiculous.

Additionally, you can argue that Amazon is not like the other marketplaces in that, with the addition of their Amazon Basics (and other private label brands) and Prime boosted listings, it isn’t a 1:1 to comparison on how your category might fair on other marketplaces.

What Categories Made a Strong Showing?

What we observed is that the category drove the first portion of success on Google versus other marketplaces. For example, consumer packaged goods (grocery) did better on Google Express than on eBay.

(Not really surprising, there’s a bit of a branding conflict there, no one really thinks to buy food on eBay that isn’t a case of Korean snack crackers to fuel their next Starcraft binge weekend.)

Pet supplies and food did extremely well in terms of number of orders and revenue versus other marketplaces.

Apparel did better in the case of several sellers, even though the platform as you navigate it today isn’t as amenable to browsing apparel as it is electronics or household items.

If you’re in the electronics, toys, health and beauty, or consumer packaged goods spaces, this is a great opportunity to check out especially if you’re already selling on marketplaces.

Walmart recently left the platform (confirmed by Google Express on January 22, 2019 via Twitter) leaving a large space for current and future retailers and brands to fill.

Additionally, we observed that the average order value of a Shopping Actions order was larger than other marketplaces – giving a little support to Google’s claim that sellers saw a 30 percent average increase in basket size versus Google Shopping.

Why You Should Take Another Look at the Program

Now if you’ve been to the express.google.com experience and started looking at the available stores and tried to envision where you’d fit in, it’s a seemingly endless scroll of 1,000+ stores active today that would contradict what I just said.

But remember that Amazon started the same way in 2000.

By 2017, Amazon was estimated to have as many as 1,029,528 third-party sellers, accounting for 52 percent of 2018’s Q4 business.

In 2018, the ecommerce giant made $31.88 billion from third-party sellers.

Makes the why behind this effort from Google look a little clearer, doesn’t it?

Add in Google’s reach in search, devices and products like Gmail, Chrome, and YouTube across 1 billion devices you really start to see what might be left on the table.

Not convinced yet?

How to Optimize Your Shopping Actions Listings

Let’s dive into some optimization recommendations, most of which leverage existing Google properties or workflows for Shopping that can be re-used or replicated.

1. Product/Catalog Data

If you’re already on Google Shopping running PLAs, you already have the feed, and Shopping Actions will share almost all the same attributes, especially the product title and description – why not put that hard earned, cleaned up data to work for you twice?

2. Google Manufacturer Center

If you’re the brand or manufacturer, you should take advantage of this free upload to Google.

This helps you set the record straight on features and data about your products and, in some cases, correct incorrect data that an overzealous reseller or retailer has proliferated throughout the internet.

It is what will inherently be used in determining which version of a product description to show, especially if the PLA version has positive performance history – that will be the default description unless a submission through Google Manufacturer Center “corrects” it.

3. Google Merchant Promotions

Submit the same Google Retail Promotions feed (or set up directly in Merchant Center) for Shopping Actions and get more exposure for work you were doing already for Google Shopping. Or, have a unique promotion or offer for your storefront on Express to drive sales.

And while you may not be able to directly set this up or are guaranteed when these happen, Google often has sponsored promotions like free shipping on orders over $15 and 20 percent orders for first time Express users that are subsidized by Google. (i.e., free coupon for you!)

4. Unique Pricing

Don’t want to do a promotion and would rather have unique pricing lower for Shopping Actions? Would you rather try and “bake” the cost of shipping into a final price so you can say “free delivery”?

Use a supplemental feed to submit specific pricing information to Google. Just make sure to do it after any major feed updates (like if you have a full feed refresh scheduled once a day) so as not to overwrite your changes.

Special note here, Google has removed the requirement that you have to have a transactional website to be on Shopping Actions, so if you don’t have a website, there’s no source to price check against either.

5. Using Shopping Actions for Remarketing in Google Ads

Yes, you can.

While customers have to opt-in to releasing their email to the seller during the checkout process on Google Express, they sometimes do.

In which case, you can take those email addresses and add to a mailing list or upload for some Customer Match fun.

You’ll know how much a Shopping Actions user is worth to you and their average order value, so why not create a special remarketing audience for them and either get them to buy again via your site?

Or again through Shopping Actions?

6. Seller Ratings

Go for the Top Retailer status, you’ll get that discount on commission rates but also, as Bill and Ted would say “be excellent to your customers.”

Also, you don’t want to get order capped. That would be bogus.

7. Shopping Actions Insights

Last, but not least, if you’re live today, be sure to check out the new beta section in Google Merchant Center.

Mostly informative now, but you’ll want to keep an eye on that Buy box metric as more sellers enter the platform. There are two reports:

- Competitiveness.

- Opt-in Recommendations.

Merchants will be able to see the competitiveness of their products, brands and categories (price competitiveness and buy box performance) plus get suggestions on which products they currently advertise on PLA that could also do well on Shopping Actions.

It’s got the same name as Amazon’s Buy Box but isn’t functionally identical. Expect to see that evolve over the course of this year but with that usual Google twist.

Conclusion

Shopping actions with Google provided additional (and unexpected) revenue to sellers who onboarded last year.

That said, the ability to forecast or look back is so short.

It’s hard to say what the future will be, especially with the heavy personalization aspects like Google’s ability to know when to show a Shopping Actions result versus Google Shopping or whatever else they come up with this year.

The fun part is knowing that opportunity is there, but not knowing how much yet, since it’s all still so new. At least, I think it’s fun.

More Resources:

Image Credits

All screenshots taken by author, February 2019